What is tax code br

What does my tax code mean? Tax codes with ‘K’ at the beginning mean you have income that is not being taxed another way and it’s worth more than your tax -free allowance.

There are three main reasons people are put on this code. You have been allowed no tax free amount. BR means base rate. If this is a new job this is probably in hand.

The addition of a ‘W1’ and ‘M1’ indicate that your tax is non-cumulative, either on a weekly or monthly basis. Thus, all your income from one particular job or pension gets taxed at the basic rate.

As a rule it gets used for people with more than one job or more than one pension. It’s used for most people with one job and no untaxed income, unpaid tax or taxable benefits (for example a company car).

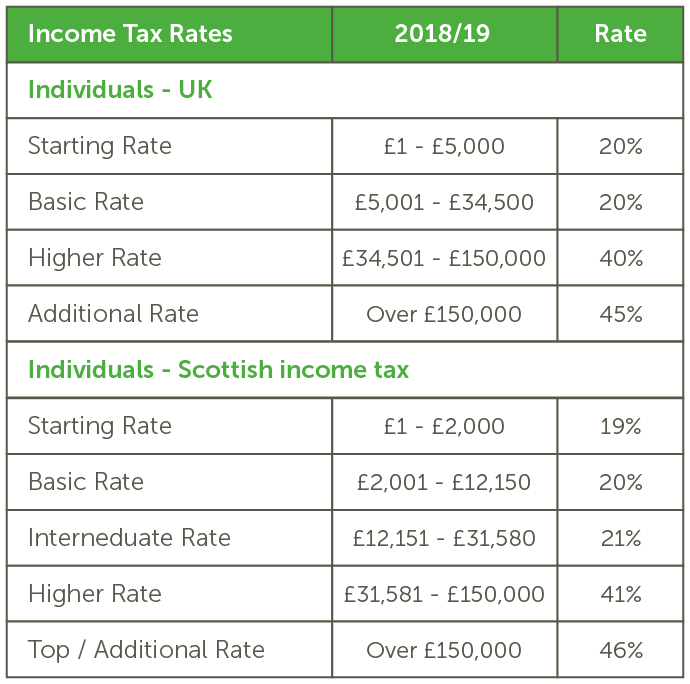

However, it is possible that your extra income could push your total earnings for a year into a higher tax bracket (if earning over £4351) – meaning you may have to pay more tax. When calculating tax for a pay period you must ignore all. Wand M1: emergency tax codes. An emergency tax code is issued if HMRC does not have enough information about you to send your employer the correct code.

The tax code letter gives your employer further information on the type of allowances you receive or the rate of tax that should be charged. Find out more: tax -free income and allowances - how much you can earn before paying tax. If you think your tax code could be wrong, you should contact HMRC.

After your tax code changes. They will also tell your employer or pension provider that your tax code has changed. Some Inland Revenue tax coding consists of just letters allowing the tax codes explained simply.

It represents £18of tax -free income. Form Phad been issued. TAX CODES are used by an employer or pension provider in order to work out how much Income Tax should be taken from the pay or pension payment. One particular tax code may mean an individual is.

A normal tax code is 647L which means that you can earn £5per month tax free. This applied to all. It takes account of the basic rate, higher rate and additional rate tax.

You will therefore receive no personal allowances but you will not be subjected to higher rates of tax. The numbers within UK tax codes are a direct reference to the amount of tax -free income you get that tax year.

Add to any tax. You can find your tax code on your payslips and you can inform HMRC about starting a second job using the new starter checklist from your new employer.

If your tax code is wrong you could be paying too much tax. Your tax code determines the amount of tax you pay on earned income in the UK. Most UK residents are entitled to a tax -free personal allowance. Another common example would be someone who is drawing a state pension and a company pension, both of which are subject to income tax.

As an employer your main role in relation to tax codes is to operate the code that HMRC give you and change the code when HMRC tell you to change it. We briefly explain both of these below. Check with your payroll dept.

When you started this job Payroll should have got you a correct tax code. You will get a tax refund when HMRC advise payroll of your correct tax code. Many things can affect your tax code for the subsequent year, for example: The value of the personal allowance will usually increase from year-to-year, e. A tax code is a sequence of letters and numbers that help you determine how much tax you should be paying.

Tax codes are regulated by HMRC and they can differ based on your circumstances – the system works by taking the amount of tax you owe off your sa. You should keep a copy of the information that you provide to your employer in case, later, there is a dispute.

Category B is usually the one that is most confusing.

Comments

Post a Comment