What is my payroll number

What is an example of a payroll number? How are payroll resources determined? For example, if you are paid monthly, this would translate as: = April and = March.

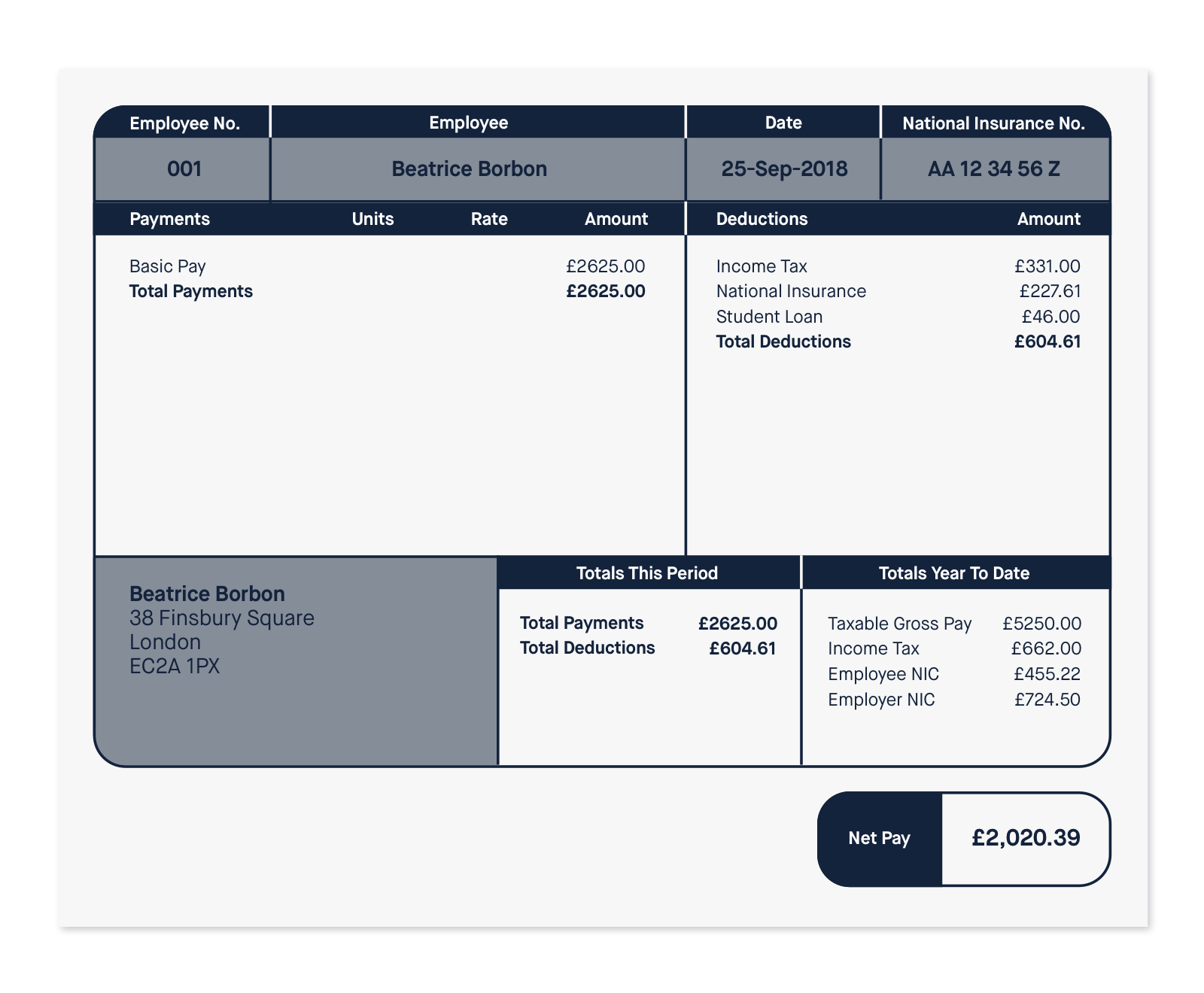

Your tax code – This indicates the rate you’re taxed at. Your National Insurance (NI) number – Your NI number confirms that you’re eligible for work in the UK. The payroll number is a set of numbers assigned to an employee as a reference for salary reports.

Wages are calculated and assigned to the employee according to his or her number, which is also called an employee number or staff ID. A payroll number is usually three to eight digits long, depending on the number of employees in the department. To find this number : 1) Navigate to the Pay and Benefits section of ESS.

A link to this section is available in the menu at the top of the screen in Employee Self Service. Select a payslip to open the simplified version of that payslip. Sage line is the wrong programme, that is for accounts not payroll. You need Sage Payroll.

Talk to their customer services line and ask all the. They will know because your tax code will change to "NT" meaning no tax, the people in your payroll will have seen this before.

Payroll number may or may not be on payslip, Depends on what format employer uses. It is possible the 1will be payroll number, check with payroll. Income tax week is from. Your Key ID will always stay the same, even if you leave Key Portfolio and then rejoin.

The date your pay should be credited to your bank account is usually shown. Some companies use payroll numbers to identify individuals on the payroll. The number here represents the tax period for that payslip, for example, if you’re paid monthly, = April and = March. Assignment Number Uses the first digits of your Employee number.

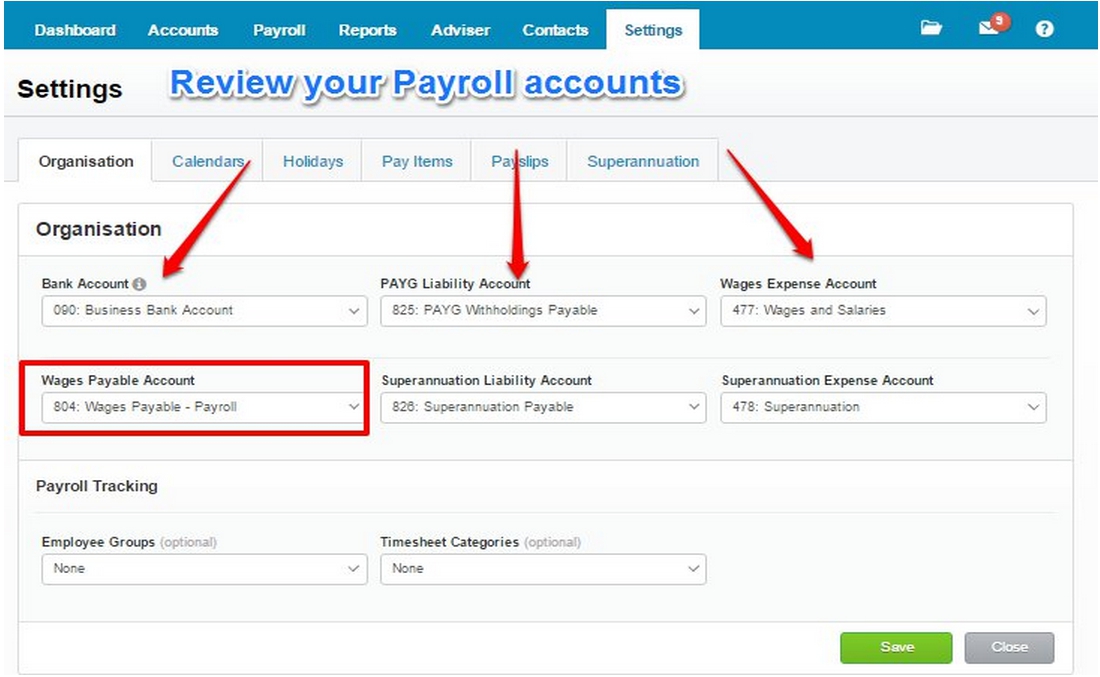

If you have more than one post these will be indicated by the addition of --etc. Browse: Payroll A to Z. Your payroll software will work out how much tax and National Insurance you owe, including an employer’s National Insurance contribution on each employee’s earnings above £1a week.

Employer reference number is a unique number containing a set of letters together with number provided by HMRC to identify your business. It is provided when you first register yourself as an employer with HMRC. It is also mentioned on tax forms as an employer PAYE reference number.

All your personal data organisation data, benefits, time data, payroll data etc are linked to the payroll number. In today’s word where hybrid or cloud model is very popular your payroll number might be different from your employee I now this is upto the employer what they prefer to use.

This is a unique employee number issued to you by your employer. The best place to find this information is on your payslip. Otherwise, contact your HR department or manager. Your payroll (or employee) number is the number used by your employer to identify you for payroll purposes.

Your personal information. If you have an issue with your pay and need to speak to your employer about it, it’s useful to have this to hand. Your name and sometimes your home address will usually be shown on your payslip.

It’s a unique set of letters and numbers used by the taxman and others to identify your firm. This reference is made up of two parts: a three-digit HMRC office number, and a reference number unique to your business.

Unique Taxpayer Reference (UTR) Unique Tax Reference (UTR) is a 10-digit number provided by HMRC when a person registers for self-assessment or sets up a Limited Company. Your business will need it when submitting the Company Tax Return. An employer reference number is a unique combination of letters and numbers, also called an employer PAYE reference, PAYE reference number or just abbreviated to ERN. HMRC also issues UTRs for individuals.

The people you have to contact are the people in your Company who do the the wages ( payroll ). They should have your correct tax coding. Have you talked to your Manager?

That would be your employee number.

Comments

Post a Comment