How is ppi calculated

How do you calculate a PPI claim? How much is PPI interest per year? What is the PPI compensation rate?

For example, you might have taken out a loan of £10and the PPI policy was £50 creating a total of £1500. If the loan had an interest rate of 7. AER, the PPI policy will have had the same. Use our PPI calculator to work out how much you may be entitled to. A PPI refund calculation example based on a £0loan, at 7. You sound confused about PPI.

Interest payable on the PPI amount: £0x 7. There would be a seperate fee on your statements for PPI, it has nothing to do with the APR. It is an Insurance taken out that you can claim on if you are sick or become unemployed. You would have to prove that. Total PPI Refund Due: £x months = £6for years.

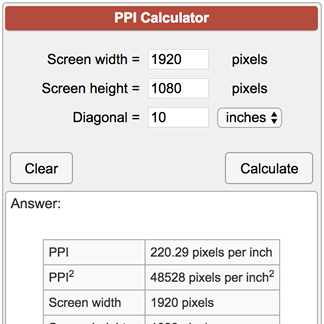

Total = £6PLUS statutory interest at 8% per year. Use the formula to calculate PPI, dividing the length of the diagonal in pixels by the length of the diagonal in. The PPI interest is calculated at £1per year.

Across five years, this equated to £7interest on the PPI policy. The technical PPI definition is Pixels Per Inch, and it represents a measurement of the pixel density of a screen or a digital image. PPI Calculator Information You could be owed £££’s for mis-sold PPI and be eligible to a PPI refun why not try our PPI Calculators above to see how much you could be owed?

If you were a non-taxpayer in the year the PPI was paid out (eg, currently that means those earning less than the £15personal allowance), unless the statutory interest pushes you over the taxpaying threshol you can claim. You probably noticed that you can also enter the width and height of the display into the PPI calculator.

The producer price index ( PPI ) is a family of indexes that gauges the average fluctuation in selling prices received by domestic producers over time. The following pages give examples of how PPI compensation may be calculated.

They do not cover every situation. If a customer has received PPI compensation that does not fall into one of these. In fact, different banks may interpret the refund guidelines slightly differently. Calculate PPI refunds easily with this PPI calculator.

But at the core of it, you should get back the PPI premiums you originally paid with 8% simple interest added. So the total interest due on the PPI premiums is £0.

Compensation for interest lost on PPI premium payments ‒ Example You have paid PPI premiums of £47. Horizontal resolution: pixels Vertical resolution: pixels Diagonal: inches (xx cm).

Payment protection insurance (commonly referred to as PPI ) was designed to cover your loan or credit card repayments for a year in the event of an accident, sickness or, in some cases, unemployment. Various approaches can be employed to calculate PPI. The method that is most commonly employed involves calculating the pixels per inch from the diagonal screen size (in centimeters or inches) and the number of pixels along the horizontal and vertical edges of the display.

In case you want to know the amount you could get from your PPI claim before you get an outcome from the bank, you can use our PPI calculator to estimate the payout. In the event that you have your financial agreements with confirmation of PPI, you can pop it into the number cruncher and it will assess the amount you could get from the bank. The way PPI payouts are calculated means millions of people are entitled to a second wave of cash back potentially worth hundreds more, MoneySavingExpert.

Martin Lewis has said. It can include an interest element. The links below are to examples based on the most common scenarios. Challenging rip-off high commission for PPI claims.

Please can someone let me know if what they are telling me is correct? I have no idea how to. This breaches FCA rules.

Comments

Post a Comment