How is ssp calculated

What is the weekly rate for ssp? How do you calculate SSP? Browse: Employing people A to Z. Contracts of employment and. When you have worked out the AWE, calculate how much SSP is.

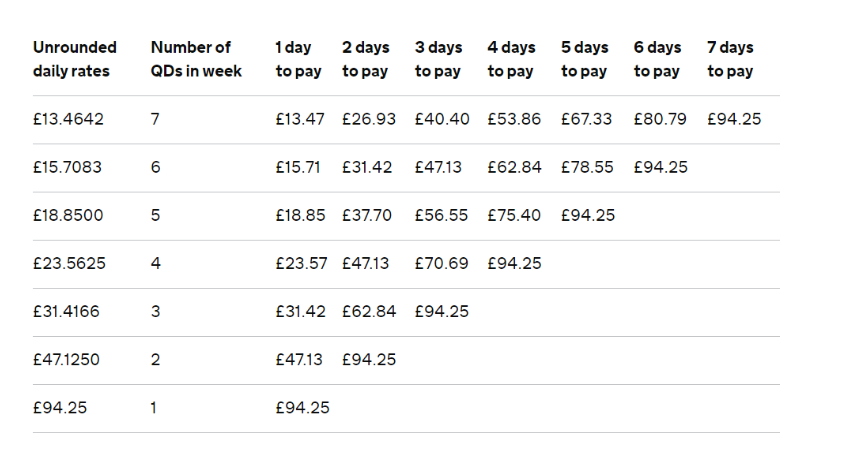

There’s a weekly SSP rate that you can use to calculate how much SSP to pay your employees. The SSP rate in the UK. You can use a daily SSP rate if your employee isn’t off work for the whole week. To calculate SSP, the weekly rate (£95) is divided by the number of qualifying days in a week and multiplied by the number of days for which an employee is entitled to.

In this case, Jane was off sick for qualifying days (of which SSP will be paid for of them0). It is £a week, if you are earning less than £a week you will get a form to fill out to claim sickness benefit from the DHSS, if it is more than £your employer will have to pay you, you have to wait days before getting paid these.

Sorry to say that everyone is correct. If you are off sick again within a week period you wont have to wait all days again, but more than this and you start again from scratch.

It depends on how the months wage is calculated. It may be from (as an example) the 15th to 14th of a month or the 10th to the 9th or whatever.

This is because payroll departments need time to process and prepare wages to be paid out on the. SSP calculator You can work out the daily rate for your employee by dividing the weekly rate by the number of QDs in that week. For SSP purposes, the week always begins on a Sunday.

SSP is paid when the employee is sick for at least days in a row (including non-working days ). You cannot count a day as a sick day if an employee has worked for a minute or more before they go. Employees who have been paid less than weeks of earnings still qualify for SSP.

Use the sick pay calculator to work out how much to pay them. An employee’s period of incapacity for work is not.

Statutory sick pay ( SSP ) is paid to employees who are too unwell and unable to work for a period of four days or more. Currently, the SSP rate for employees who are eligible is £95. This statutory amount can be increased if an employer offers a sick pay scheme, however the SSP rate will never be any less that £95.

If an employer pays more than SSP it’s known as ‘company’, ‘contractual’ or ‘occupational’ sick pay. If there’s nothing in writing. It’s a good idea to check your workplace’s policy to see if your. SSP currently stands at £89.

Statutory Sick Pay ( SSP ) is the minimum amount employers must pay. Part-time workers are paid pro-rata. This handy sick pay calculator can help you work out how much SSP your employee is. Company sick pay (also called contractual or occupational sick pay) is paid by the employer with entitlements decided by the employer and written into the employment contract.

As Sage 50cloud Payroll calculates SSP to start on the fourth day, after serving the first three waiting days, for any employees affected by COVID-that you want to pay SSP from day one, you need to set up and assign a pay element called Coronavirus SSP to your employees. You can then record the amount of SSP that you want to pay the employee in Enter Payments. To record the absence in the.

Can somebody please explain to me how SSP is calculated. As far as I can gather, its something like £75. Divide that by the amount of days an employee is off sick and thats their daily rate. You only qualify after the days waiting period so if.

Similarly, should the employer part be calculated on the whole amount payable including the SSP. Or - should the employer contribute the full amount (ie including a percentage of the SSP ) without making any deduction.

Normally, absence for us is only the odd day per month per hea so never really cropped up. This time, though, I have someone.

Comments

Post a Comment