How does car leasing work

What is leasing a car? How does leasing work?

You might not know it, but the two common ways of financing a car are personal contract hire (PCH) and personal contract purchase (PCP ). PCH leasing allows you to drive a new car every few years, with relatively low monthly payments and no worries about the car’s resale value. PCP is similar, but gives you the option of buying the car in the future.

Leasing, sometimes referred to as PCH (Personal Contract Hire), works like a long-term car rental. When the contract is up, hand the car back and search for a new one. Hey, In a nutshell, you have to pay for insurance (usually most companies make you take out fully-comprehensive insurance) and fuelling the vehicle.

So that will be your biggest hurdle to jump over. Unless you take out a maintenance. I sense that you think that leasing is like renting. The amount of miles.

A lease is a contract in which one party conveys the use of something (a parcel of land, building, service, or another object) to another party for a specified period of time in exchange for payment of money, typically on a periodic basis. In a car lease, the object being conveyed is the vehicle itself. It allows you to drive your chosen car for a fixed length of time at an agreed monthly price. Car leasing is a financial agreement between you and a vehicle supplier.

We understand that leasing can be a complex and daunting concept. That’s why we’ve simplified and explained everything you’ll need to know. Leasing a car is like leasing – or renting – anything else. When you lease a car, you only have to pay.

If you rent a house or flat, you pay a deposit, then you get the use of it for an agreed period during which you pay a set amount each month. Once the contract ends, the property reverts back to the landlord.

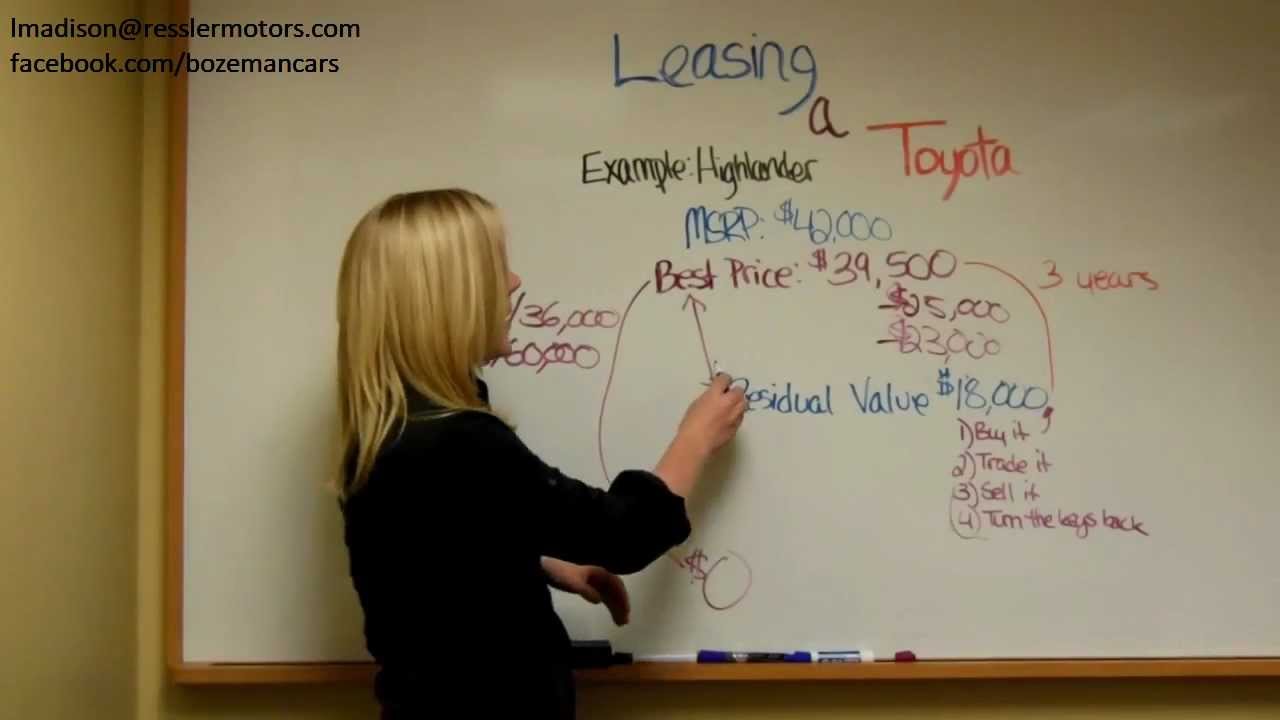

After all, as we said earlier, a lot of the information out there assumes that you have a basic understanding of car leases. So, if you don’t really understand how car leasing works or what it actually is, it can be very confusing. With car leasing you make monthly payments over a set period for the privilege of driving a brand new vehicle, but you never own it. Over the course of your contract, your monthly payments go towards paying off the amount that your car depreciates in value.

A car lease is an agreement between a lessor (the company that owns or will buy the car ) and the lessee (the person who will pay to borrow the car ). Need to replace current NHS Trust car in April. So, first thing’s first, what is car leasing? Basically, you have your car for a set period of time.

You then make monthly payments for the duration of your agreement and when that time is up, you hand the car back. A car lease (or ‘finance lease’) is a form of car finance which enables business owners, employees, contractors or self employed to have the use of a car (or commercial vehicle, motorcycle, or another form of suitable transport) and all the benefits of ownership, with the tax benefits that come from having another company (in this case the finance company) maintain ownership of the vehicle.

A majority are also VAT registered and are also completely independent. HOW DOES LEASING WORK ? Over the recent years, car leasing has become a popular alternative to buying a new car in the UK, with many people now enjoying the numerous benefits that leasing offers.

Rather than borrowing money to buy a car, a lease is a contract under which you pay for the use of the car. A car lease can also offer simplicity because it can include running costs like servicing and insurance – you pay a monthly amount and let the lease company take care of it. All Car Leasing do not own the vehicle or have a collections department and unable to provide this service.

Please view your contract with the finance company for specific details pertaining to your arrangement. Brand New Car - Personal leasing offers you the opportunity to wangle yourself a factory-fresh car every couple of years. Vehicle Excise Duty (VED) - More commonly known as road tax, VED is usually covered with personal leasing.

No MOT - Most lease contracts are agreed for around years, so your lease car will never be old enough for an MOT test. If you choose to lease a car on a personal contract hire basis, you will make a series of monthly payments for the duration of your lease agreement (or months, for example), having already paid an initial rental.

You pay for the use of the vehicle throughout your contract, and then return the car to the finance company at the end of the agreement without any further obligations, leaving you free to lease or purchase another vehicle. Business Contract Hire (BCH) is the method that businesses can finance their vehicles with a minimum down payment and an agreed mileage for the contract. A personal contract hire (PCH) plan is a form of car leasing where you never own the car.

If you’re not planning to buy the car at the end of a PCP, a PCH might be a cheaper option. Here’s how PCH works: You may need to pass a credit check and pay a few months’ lease upfront, typically three months’.

Instead of researching bank loans and PCP or HP agreements with car dealers, your monthly car payment is simply taken off your wage packet. Plus, your car payment is made before tax is deducted.

Comments

Post a Comment