Salary sacrifice car scheme

Struggling to decide? Choose your next company car at your nearest Ford dealer. How does the salary sacrifice Car Lease scheme work? What is salary sacrifice car? Is salary sacrifice taxable? Are salary sacrifice schemes closed? For the most part, salary sacrifice schemes involve trading in a portion of pre-taxed annual salary in return for goods or a service. Leasing an electric car via a salary sacrifice scheme.

This is an additional tax that is charged monthly and based on the value of the car, its COemissions, and your tax bracket. Because of the BIK rules, electric cars are very tempting on a salary sacrifice scheme because electric cars will. Well, there is no easy way around this, you just have to make money as best you can and save up a deposit. It maybe best work attempt to get a flat share or rent a room in the first instance.

However, the longer you can stay at home to. Our salary sacrifice car scheme helps you attract, reward and retain your employees.

It’s a totally simple idea – your employees can choose to use some of their salary before it’s taxed in exchange for the use of a brand new car. Largest tax savings are seen on the lowest COemission vehicles.

On the first page input current gross salary before sacrifice and adjust the assumptions if necessary. From the second page, select a derivative to see the impact on the driver, where scenario one shows the position before salary sacrifice and scenario two is after salary sacrifice. Salary Sacrifice Calculator.

Examples of salary sacrifice benefits. A salary sacrifice arrangement is an agreement to reduce an employee’s entitlement to cash pay, usually in return for a non-cash benefit. As an employer, you can set up a salary sacrifice. This means the only cost to you will be the salary deduction, based on the monthly lease cost of the vehicle.

Car salary sacrifice is a way of providing employees with access to brand new cars at a significant discount, paid for by deductions from their gross salary. Existing agreements.

Electric cars save you and your business money We can set up a salary sacrifice scheme in your business, to help your employees save up to 50% on their electric car lease through their salary. The monthly cost for a Tesla Model Standard Range Plus with no deposit down over months could be roughly £53 but under salary sacrifice for a higher rate taxpayer it effectively costs per.

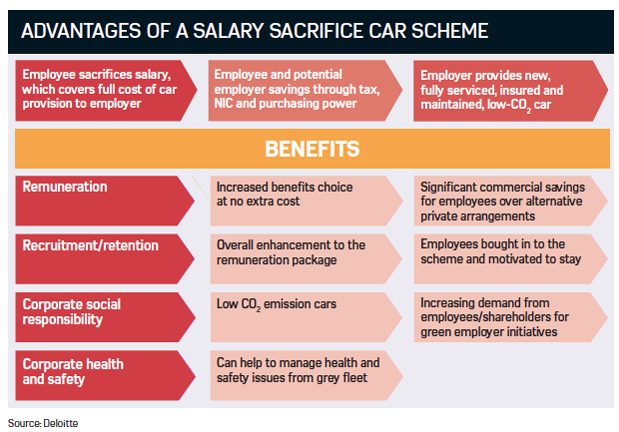

In a salary sacrifice car scheme, an employee forgoes a portion of their gross salary in exchange for savings on tax and national insurance (NI). The employee will save tax and NI on the sum that has been sacrifice and the value of the car benefit is subject only to benefit-in-kind (BIK) tax. The usual way for salary sacrifice and cars is that the employer buys, or more commonly leases, the car and it is then provided to the employee as a company car.

The employee never becomes the owner of the car unless the owner sells it to him at some time. Whether you’re in the public or private sector, looking for salary sacrifice cars, contract hire or daily rental, we’ve designed a collection of innovative, end-to-en super simple car schemes. All designed to make life on four wheels as easy, secure and cost effective as possible.

Implementing a salary sacrifice car scheme Overall, a car salary sacrifice scheme is straightforward to introduce, and offers employers a low-cost option to reward staff. There are no credit checks required for the driver and no large up-front payment on the vehicle.

Every vehicle comes with a risk protection package: if an employee needs to return the vehicle before the end of its contract, you won’t pay early termination fees†. This notional salary is your pay rate before any salary sacrifice arrangements.

So, if your salary was £30before a car salary sacrifice (or any other salary sacrifice), this is the figure your employer will refer to when calculating other benefits like pension contributions an in some cases,over time and pay rises too. Tax rules for car salary sacrifice schemes. The Car Parking benefit allows employees to make considerable savings off their daily parking costs.

Enjoy Benefits negotiates discounted rates with parking providers. The network includes NCP, Q Parks and Euro Car Parks and dozens of regional providers.

Comments

Post a Comment