Calculate apr on loan

How to compare loans. Read our guide to loans and decide what kind of loan you want. When you know which type you want, use the comparison table on the relevant page to see what loans are available. We have comparison tables you.

Use the comparison table to look at the provider, the loan, the. Using the above example, multiply £5(the loan amount) by 5. The interest is 3% per week on the outstanding balance. You would repay the £1loan by weekly payments of £9.

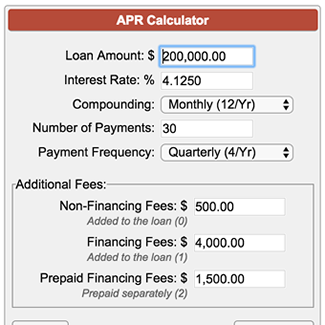

APR amount: 10X 5. The instalment is calculated as follows. It depends how the lender accrues the interest. There is no single answer to this.

Some banks and building societies add the interest at the start of each year. Then you end up paying off that interest in each monthly payment even though. Your capital repayment is £333. What is mortgage loan calculator?

Representative example: 5. Monthly repayment of £190. Total amount payable £1423. Subtract the amount borrowed from the total payment amount to find the loan’s total interest payments. Divide the total interest charges by the.

This means that the monthly repayment and total amount repayable listed alongside any personal loan example should only be used as an indication of the minimum you will be asked to pay back. Find the current balance on your card using the most recent statement. If your card statement does not tell you your.

With a 6% flat rate, the total interest is £500. Hence 6% sounds cheap but is roughly equivalent to a costly 12% APR. This car finance calculator shows you what your monthly repayments are likely to be based on your loan amount. Just select how much you want to borrow and how long you want the agreement to last.

Then we’ll show your likely repayments based on a low, moderate and high APR. This should give you a good idea of the finance options available to you. Loan repayment calculator Work out how much you will pay each month on different-sizes loans with different interest rates by filling in the boxes below theguardian. When applying for mortgages, credit cards, car loans or any other type of credit, the issuing lender, by law, must disclose the APR.

Other terms and loan amounts are available at different rates. Estimate the average debt over the life of the loan. Loan Repayment Calculator Online- Calculators. If you are thinking of consolidating existing borrowing you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.

Calculate the monthly payment using the monthly payment formula. Multiply the monthly payment by the number of months the loan is for, to get the total repayment amount.

Deduct the principal amount from your total repayment amount to get the total interest.

Comments

Post a Comment