Monthly interest calculator

What is a monthly payment? Using our savings interest calculator will give you an idea of what interest you will receive after tax each month or year and help you make the most of your money. Simply key in the amount of savings you have, your current interest rate and choose the tax status of your account and we’ll calculate how much interest you’ll earn on that amount.

Our monthly savings calculator shows how much your savings will be worth with interest over time. If you have a savings goal, our calculator shows you how long you will need to save to reach it. If your interest is evaluated monthly for instance, the gross interest rate is divided by and that amount is added on a monthly basis instead of in one lump.

As an example, a gross interest rate of 5% calculated monthly will be applied as 0. Just enter your current balance, APR and monthly. Either way, our handy calculator will help you work out how long it will take you to clear your balance at the interest rate your card charges using different monthly payment amounts. Alternatively, you can see what monthly repayments you will need to make in order to clear your balance by a certain date.

Convert the monthly rate in decimal format back to a percentage (by multiplying by 100): 0. Your monthly interest rate is 0. This may not be the same as your account but the differences are not massive. Please use as a guide only.

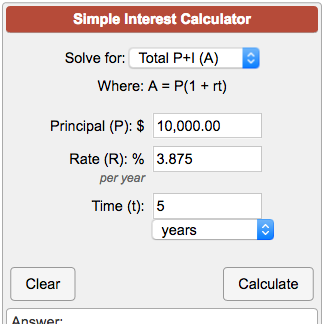

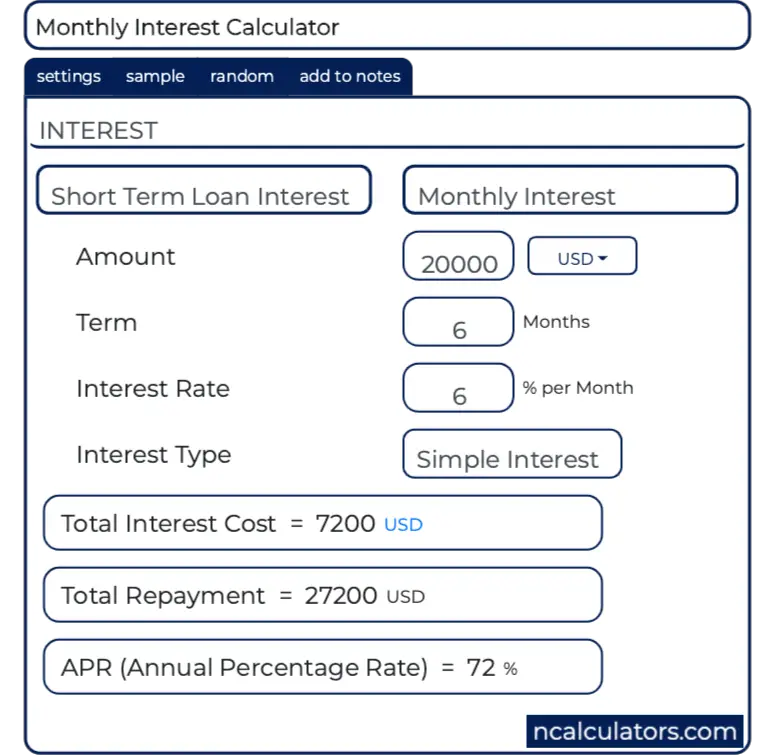

By selecting different annual interest rates (APRs), you can see how they would affect your monthly loan repayments and total loan cost. Remember, the calculator shows you an example of how much a loan would cost with that loan amount, term and interest rate – rather than the exact cost of an available deal. The simple interest calculation is one that takes a sum of money (principal) and calculates regular interest on this amount only. Calculating simple interest.

This is a direct contrast to compound interest, where interest is calculated and accumulated with each period of time (so that you accumulate interest on interest ). It is for this reason. With so many different short-term loan vehicles and other financial products available to consumers, deciphering the interest you are paying or the interest that is being paid to you can be very difficult. Tips for using our loan repayment calculator.

You can use the monthly repayment calculator to compare real-life examples. Put the interest rates, loan terms and amounts of the loans in our comparison into the loan interest rate calculator. Compare several options to find the cheapest. This calculator works for repayment, interest.

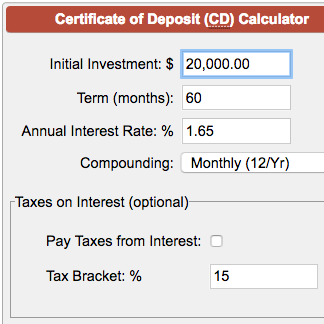

A few things to remember. It gives you an idea of the effect that Bank of England Base Rate changes might have on your monthly minimum payment and the interest you pay. Online FD calculator is used to calculate the maturity amount by applying compound interest on a monthly, quarterly, half-yearly or annual basis.

The FD calculator considers the deposit tenure, the type of fixed deposit scheme, the principal investment and the rate of interest offered by the bank, to calculate the return value at maturity. This information is computer-generated and relies on certain assumptions. It has only been designed to give a useful general indication of costs.

Loan Payment Formula. These calculators will convert a monthly interest rate on a credit card statement to the annual APR and visa versa Monthly to Annual Enter the monthly interest rate and click calculate to show the equivalent Annual rate with the monthly interest compounded (AER or APR) and not compounded (e.g. if you withdrew the interest each month).

Interest can be compounded on any given frequency schedule, and the calculator allows the conversion between compounding frequencies of daily, bi-weekly, semi- monthly, monthly, quarterly, semi-annually, annually, and continuously (infinitely many number of periods). The interest rates of savings accounts and Certificate of Deposits (CD) tend to be compounded annually. Home mortgage loans, home.

Thealso apply to daily interest where only one payment is made per month. Full usage instructions are in the tips tab below. Reduce the interest you pay.

Comments

Post a Comment