How much is maternity pay

There are rules on when and how to claim your paid leave and. Company maternity schemes. You might get more than the. Legal rights for pregnant employees - including paid time.

Payments can start weeks before your baby is due. MA which is maternity allowance - a tax free benefit from he government! If you are employed full time you get: weeks 90% of your pay or £117. Then weeks paid at £117.

Employed by the same employer without a break for at least weeks. How much is maternity allowance UK? How many weeks back do you get for maternity pay?

How can I find out how much maternity pay I have? New mums only receive statutory maternity pay (SMP) for weeks of their 52-week maternity leave. You can also use the maternity calculator on GOV. You get 90% of your average weekly earnings.

For the following weeks. The legal minimum for maternity pay If your business does not offer enhanced maternity pay, it must pay the following. During the first weeks of maternity leave.

Pay them 90% of their average weekly earnings (before tax). Unless the contract says otherwise, you do not have to provide maternity pay after. THE coronavirus pandemic is a financially uncertain time for all workers, including those who are pregnant or on maternity leave.

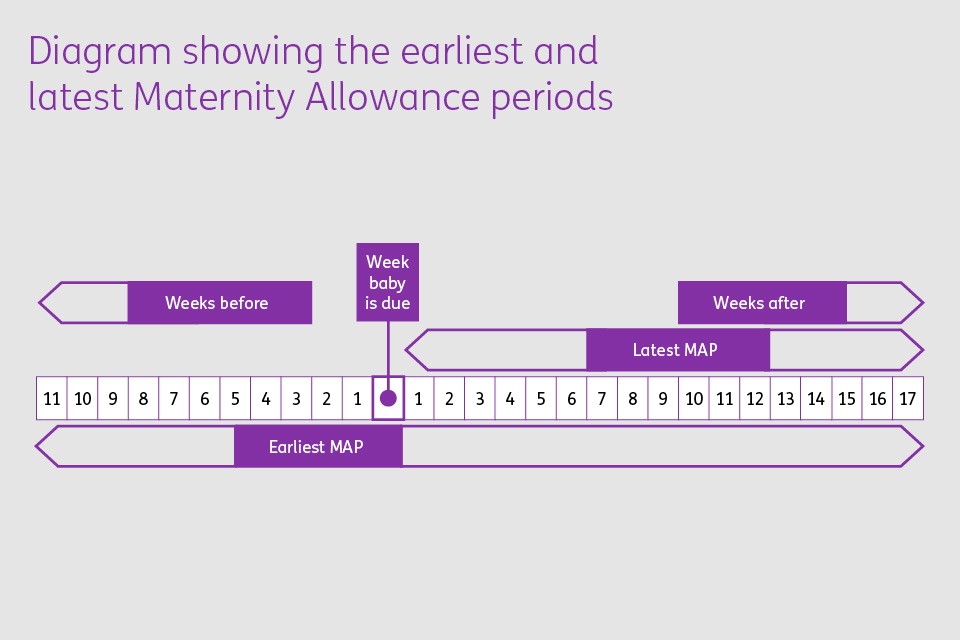

You and your partner may be able to share leave and pay. At least weeks and not more than weeks of leave must be taken before the end of the week in which your baby is due. Maternity Allowance.

Clever Tip 1: The more you earn between the 16th and 24th week before your due date the more maternity pay you get. You’re entitled to per cent of your average weekly pre-tax earnings for the first six weeks. An sorry to say, you’ll have pay-as-you-earn (PAYE) tax and National Insurance deducted from your SMP as it counts as earnings. You work during the whole 8-week maternity pay qualifying period and receive your usual pay of £2per week.

This means your first weeks of maternity pay will be £1per week. Before looking at how to recoup some of your expenditure, it is certainly worth looking at SMP in more detail and understanding the legal requirements. You will pay tax once your income exceeds your personal allowance. Use our Calculator to find out how much tax you will pay on your maternity pay.

Will I get a tax rebate during my maternity leave? Tax is based on a tax year and maternity leave usually covers two tax years. California, New Jersey, and Rhode Island for instance, operate programs that require private-sector employers to pay their employees who utilize maternity leave at partial replacement rates. If a pay-rise is awarded whilst you’re on maternity leave (and you would have received it if you were not on maternity leave), you are still treated as receiving it.

Contact your nearest Citizens Advice if you’d like help working out whether you can get statutory maternity pay again. Statutory maternity pay rates. If you do need to pay back contractual maternity pay, you won’t lose all of it.

You’ll keep what you would have got if you’d been paid statutory maternity pay instead of contractual. This could make a big difference - check how much maternity pay you’ll get to see how this could affect you.

You will not have to pay the Universal Social Charge (USC) or social insurance (PRSI).

Comments

Post a Comment