Is pension credit taxable

How much tax do I pay on my pension? Is savings credit higher than state pension? The government website states that the state pension is taxable.

Income tax also applies to most company and personal pensions, most retirement annuities, pensions paid by the Industrial Death. Savings Credit is an extra payment for people who saved some money towards their retirement, for example a pension. You may not be eligible for Savings Credit if you reached State Pension age on or.

Pension credits are usually paid to people aged an over. It is a method by which the person claiming pen-credits no longer needs to sign on at the Job Centre.

Nothing received in the Credit system of benefits is taxable. For those who qualify, it can be worth £000s a year. When you take money from your pension pot, % is tax free. You pay Income Tax on the other 75%.

Your tax-free amount doesn’t use up any of your Personal Allowance – the amount of income you don’t. You can usually take up to 25% of the amount built up in any pension as a tax-free lump sum.

The tax-free lump sum doesn’t affect your Personal Allowance. Tax is taken off the remaining amount. Victoria Cross, George Cross and most other bravery medals are non-taxable.

Hospital Travel Scheme. The state pension itself is taxable, meaning that it counts in terms of Income Tax. The payment could see those who qualify take home thousands more each year. But how much exactly can you have in.

If you’re one of these, you’re missing out on hundreds of pounds a year. The full list of current tax-free and taxable state benefits can be found at the government website. Pension income paid to you is normally treated as earned income for income tax purposes, although you don’t pay any National Insurance contributions on your pension income.

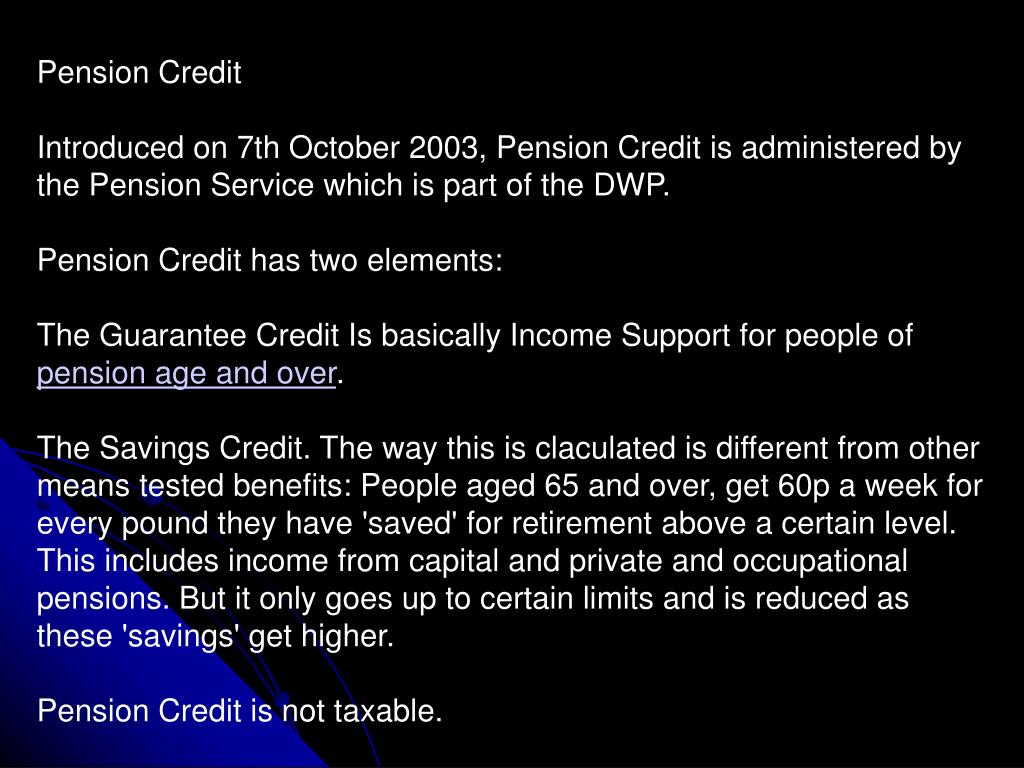

Pension Credit is a tax-free benefit aimed to help pensioners on a low income. But bear in mind that you will normally be able to take some of your pension benefits (typically up to 25% of the value of your pension) as a tax free lump sum at outset.

There is a pension credit calculator on the gov. The calculator will also give you an estimate of the pension credit payment you are due for based on your earnings, benefits, pensions, savings and investments.

If your overseas pension is taxable in the UK – because it is taxable under UK domestic law and either there is no double tax agreement or the double tax agreement states the pension is only taxable in the UK – you will need to report the overseas pension to HMRC. You may have to do this by completing a UK Self Assessment tax return. When working out your entitlement to CTR, the way some things are dealt with will be the same for all pensioners, regardless of where you live.

Income tax is payable on a number of things, with earnings, most pensions, and income from a trust all taxable. It’s not a requirement to pay tax on some forms of income. This includes some state benefits, dividends from company shares under dividends allowance, and premium bond or National Lottery wins.

Is it income for tax credits? If you receive pension credit you may be entitled to the maximum amount of working tax credit and child tax credit.

Your pension contributions are deducted from your salary by your employer before income tax is calculated on it, so you get relief on the amount immediately at your highest rate of tax. So, if you earn £3a week, and pay 3% (£9) in pension contributions, you will only pay tax on wages of £291. The federal tax credit rate is 15%, so the maximum federal tax savings available is $3($0× 15%).

There are also provincial pension income amounts. Contracting State shall be taxable only in that State. Social welfare payments are taxed by reducing your tax credits and rate band. For example, you are getting a social welfare pension and an occupational pension.

Your occupational pension is taxed through the Pay-As-You-Earn (PAYE) system in the same way as a wage or salary. This means that you get your tax credits in the normal way.

Comments

Post a Comment